At the time of foundation, Rainbow intermediaries had a firm belief that our experience in local and international insurance, reinsurance and retrocession would make a difference in the insurance industry of the country. Our beliefs proved to be real. We have observed growth of insurance industry of the country where we worked for and could feel our efforts marked in it.

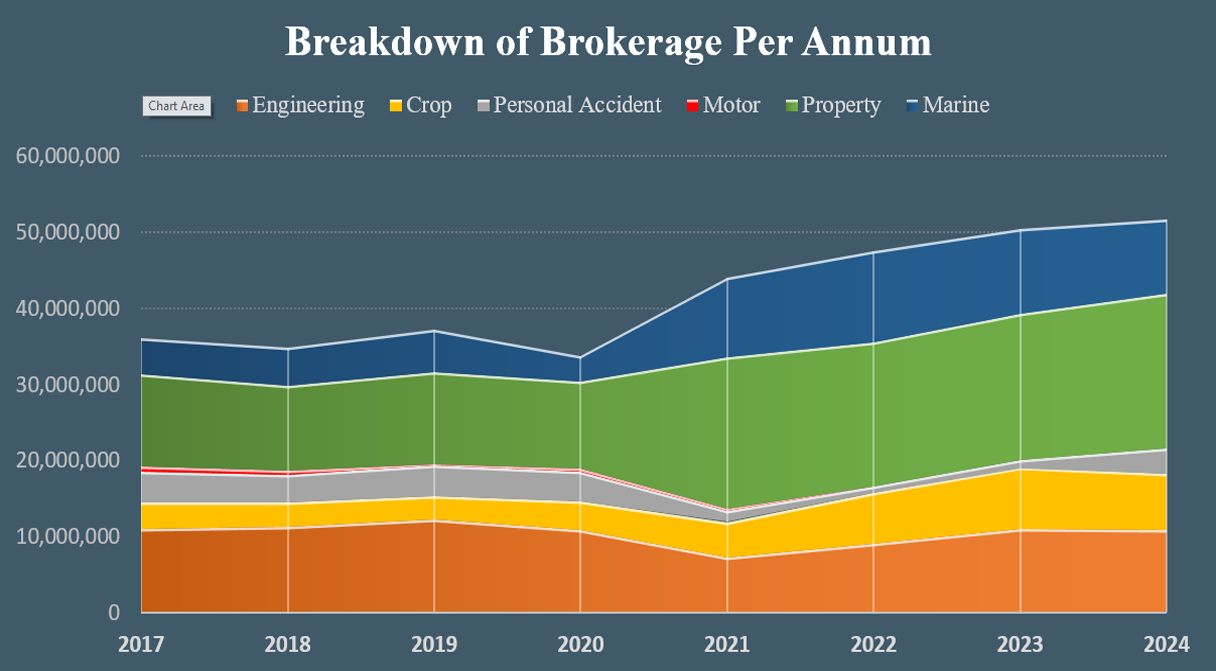

Since 2017 when we issued the first financial statement, our brokerage income has increased 43% in 2024. Our key business lines in primary insurance expanded to property, marine, engineering, crop and personal accident from which we are seeing sustained increase of brokerage.

Reinsurance remains as one of our expertise based on our profound knowledge and experience. Proportional and non-proportional treaties we have bound for property, marine and crop insurers contributed to their increased capacities and stability of operations.

We are also proud of our consultancy service that offers our expertise and knowledge to supplement success of our clients.

Our solid business ground, strong bond and trust with insurance and reinsurance markets enabled us to enter another phase of development. In 2024, we have setup another milestone in our history, being authorized by local insurance companies to underwrite insurance and reinsurance, manage claims as Managing General Agent (MGA) on their behalf.

Capitalizing on what we have achieved so far, we are striving to be a Hub of Risks and Securities, always committed to Fidelity and Professionalism.

Rainbow Intermediaries would not have reached where we are without support and trust, for which we always and sincerely thank our valuable clients and partners.

Han Chol Gyu

Managing Director

Rainbow Intermediaries