| |

|

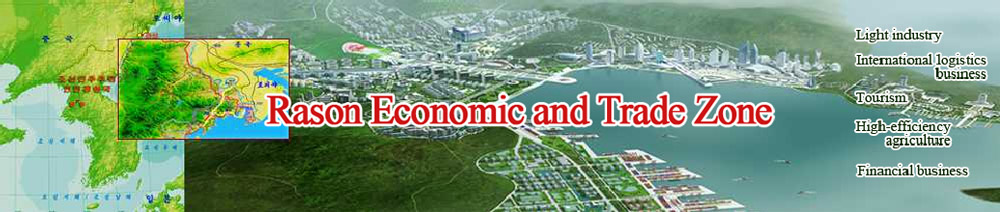

Investment environment in Rason Economic and Trade Zone Natural resources and infrastructures Finance, education and culture Projects for Development of Industrial Parks Projects for Development of Tourist Destinations Investment Projects for Local Industries Investment Policy |

The government of the DPRK has enacted and made public the “DPRK Law on the Rason Economic and Trade Zone” and other 50 regulations related to investment in the Zone and thus established legal groundwork and institutional environment for foreign investment in the Zone. ① Provision of preferential treatment for economic activities ―Such income as profits, interests, dividend, rentals, service charges and proceeds from property sale that are legitimately earned in the Zone may be remitted outside the territory of the DPRK without any restrictions. ― Investors may take out of the Zone without any restrictions the property that had been brought therein or legitimately acquired therein. ― Enterprises or individual foreign businesspersons in the Zone may, under contracts with the enterprises in or outside the Zone, conduct transactions of commodities, services and technology, and conduct agent’s business for export and import. ― Land for the use of enterprises in the Zone shall be provided in consideration of actual demand, and depending on the sector and the purpose of land use, different preferential treatment shall be accorded in such respects as term of lease and method of paying rental charge. ― Enterprises investing in the construction of infrastructures and public establishments and top priority sectors shall be given a prior lien in selecting the location of land, with the land use rent exempted for a designated period of time. ― An enterprise in the Zone may, within the term of validity, assign, lease or mortgage the right to use land and the ownership of buildings through sale, exchange, donation and succession. ― Enterprises in the Zone shall have the independent rights to formulate the rules for management and operation, to work out plans for production, sale and financial management and to determine the forms of employment, wage level and form of its payment, price of products and plan for profit distribution. Illegal interference in the operation of business shall be prohibited, and expenses and obligation that are not prescribed in the laws and regulations shall not be imposed. ― Services for managerial work such as banking, insurance, accounting, legal work, measuring may be provided in the Zone in accordance with the regulations. ― International tourism may be widely encouraged in the Zone by developing seaside pine groves, sand beaches, islets and other peculiar scenic beauties, and favourable tourist resources related to folk culture. ② Preferential treatment in taxation ―Where dividends are reinvested in the Zone to increase the registered capital or to set up a new business for more than 5 years, 50 % of the enterprise income tax paid on the reinvested amount shall be refunded. ― Where reinvestment is made in infrastructure construction, the whole of the enterprise income tax paid on the reinvested amount shall be refunded. ③ Entry and exit of goods ― Preferential tariff system shall be enforced. Goods may be freely brought into the Zone, and they can be stored, processed, assembled, sorted and packed to be taken out to other countries. ― Duty-free articles shall be brought into or taken out of the Zone, subject to declaration. ④ Entry/exit, stay and residence of foreigners and welfare service for them ― Foreigners may enter, leave, stay or reside in the Zone. Visa-free system is in force in the Zone upon presentation of a passport or other equivalent pass. ― Mail, telephone, fax, and other communications devices shall be freely used in the Zone. Residents and visitors shall be provided with facilities in the fields of education, culture, medical care and physical culture. ⑤ Preferential treatment to developer enterprise ― A developer enterprise shall acquire a preferential right in obtaining the right to the management of tourist business, hotel business and others. ― Tax shall not be levied on the property of the developer enterprise and the infrastructures and public establishments that he/she operates. |